Decision Vision Episode 77: Should I Get to Know my Employees on a Personal Level? – An Interview with Alain Hunkins

Decision Vision Episode 77: Should I Get to Know my Employees on a Personal Level? – An Interview with Alain Hunkins

Alain Hunkins joins host Mike Blake to discuss moving leadership from a transactional to a personal level, a particularly important topic as employees expect more from their relationships at work than ever before. “Decision Vision” is presented by Brady Ware & Company.

Alain Hunkins, Hunkins Leadership Group

A sought-after keynote speaker, facilitator and coach, Alain Hunkins is a leadership expert who connects the science of high performance with the performing art of leadership. Leaders trust him to help unlock their potential and expand their influence, leading to superior results, increased engagement, higher levels of retention, and greater organizational and personal satisfaction. He has a gift for translating complex concepts from psychology, neuroscience and organizational behavior into simple, practical tools that can be applied on the job.

Over the course of his 20+ year career, Alain has worked with tens of thousands of leaders in over 25 countries, and served clients in all industries, including 42 Fortune 100 companies. He delivers dynamic keynotes, seminars, and workshops covering a variety of leadership topics including communication, team building, conflict management, peak performance, motivation, and change.

With his Master’s in Fine Arts in Acting from the University of Wisconsin-Milwaukee’s Professional Theater Training Program, and a BA from Amherst College, Alain also serves on the faculty of Duke Corporate Education, ranked #2 worldwide in 2018 by Financial Times on its list of customized Executive Education programs. Alain has lectured at UNC Kenan-Flagler’s business school and Columbia University.

With his Master’s in Fine Arts in Acting from the University of Wisconsin-Milwaukee’s Professional Theater Training Program, and a BA from Amherst College, Alain also serves on the faculty of Duke Corporate Education, ranked #2 worldwide in 2018 by Financial Times on its list of customized Executive Education programs. Alain has lectured at UNC Kenan-Flagler’s business school and Columbia University.

Alain has authored over 400 articles, and been published by The Association for Talent Development, CEO Refresher, and the American Management Association.

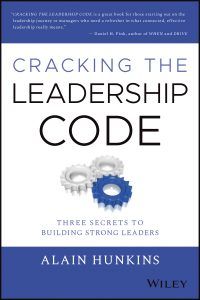

Alain also authored the book Cracking the Leadership Code: Three Secrets to Building Strong Leaders.

A certified co-leader for ManKind Project International, a non-profit whose mission is to help men lead lives of service to their families, communities, and workplaces, he’s based in Northampton, MA with his wife and two children.

To connect with Alain, visit his website or connect with him on LinkedIn.

Michael Blake, Brady Ware & Company

Michael Blake is Host of the “Decision Vision” podcast series and a Director of Brady Ware & Company. Mike specializes in the valuation of intellectual property-driven firms, such as software firms, aerospace firms and professional services firms, most frequently in the capacity as a transaction advisor, helping clients obtain great outcomes from complex transaction opportunities. He is also a specialist in the appraisal of intellectual properties as stand-alone assets, such as software, trade secrets, and patents.

Mike has been a full-time business appraiser for 13 years with public accounting firms, boutique business appraisal firms, and an owner of his own firm. Prior to that, he spent 8 years in venture capital and investment banking, including transactions in the U.S., Israel, Russia, Ukraine, and Belarus.

Brady Ware & Company

Brady Ware & Company is a regional full-service accounting and advisory firm which helps businesses and entrepreneurs make visions a reality. Brady Ware services clients nationally from its offices in Alpharetta, GA; Columbus and Dayton, OH; and Richmond, IN. The firm is growth minded, committed to the regions in which they operate, and most importantly, they make significant investments in their people and service offerings to meet the changing financial needs of those they are privileged to serve. The firm is dedicated to providing results that make a difference for its clients.

Decision Vision Podcast Series

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at decisionvision@bradyware.com and make sure to listen to every Thursday to the “Decision Vision” podcast.

Past episodes of “Decision Vision” can be found at decisionvisionpodcast.com. “Decision Vision” is produced and broadcast by the North Fulton studio of Business RadioX®.

Visit Brady Ware & Company on social media:

LinkedIn: https://www.linkedin.com/company/brady-ware/

Facebook: https://www.facebook.com/bradywareCPAs/

Twitter: https://twitter.com/BradyWare

Instagram: https://www.instagram.com/bradywarecompany/

Show Transcript

Intro: [00:00:01] Welcome to Decision Vision, a podcast series focusing on critical business decisions. Brought to you by Brady Ware & Company. Brady Ware is a regional full service accounting and advisory firm that helps businesses and entrepreneurs make visions a reality.

Mike Blake: [00:00:21] And welcome to Decision Vision, a podcast giving you, the listener, clear vision to make great decisions. In each episode, we discuss the process of decision making on a different topic from the business owner’s or executive’s perspective. We aren’t necessarily telling you what to do, but we can put you in a position to make an informed decision on your own and understand when you might need help along the way.

Mike Blake: [00:00:40] My name is Mike Blake, and I’m your host for today’s program. I’m a director at Brady Ware & Company, a full service accounting firm based in Dayton, Ohio. With offices in Dayton, Columbus, Ohio, Richmond, Indiana, and Alpharetta, Georgia. Brady Ware is sponsoring this podcast, which is being recorded in Atlanta for social distancing protocols. If you like this podcast, please subscribe on your favorite podcast aggregator and please consider leaving a review of the podcast as well.

Mike Blake: [00:01:07] So, today’s topic is, should I get to know my employees on a personal level? And this is a topic in business leadership that has been percolating and, I think, bubbling up to the surface really for some time. You know, it’s either been couched in certain other leadership contexts.

Mike Blake: [00:01:32] One of my favorite books on leadership by a retired naval officer named Michael Abramoff called It’s Your Ship. I heard him speak and then later read his book. And it’s a story about how he took over the the lowest performing or lowest performance rated destroyer in, I think, it was the US Pacific fleet and turned it around into the highest performing destroyer in the course of his two year tour. And terrific book. And I’m always fascinated in how you can potentially translate military leadership into the civilian sector. But one of the things that comes across very clearly in that book is that even though he had, you know, a destroyer full of officers and seamen by the hundreds, you know, he got to know most of them and care about them. And you can talk about the other things he did, which I think were very important.

Mike Blake: [00:02:32] Some of the things that I do as an aside, one of the things that I get questioned on a lot is back in the days when our firm used to actually work in an office and we would eat together, I would always make sure that I ate last or at least I ate after any of the non-partner employees did. And people would ask me, “Why do you do that?” And I said, “Well, that’s a military tradition where the enlisted people always eat first.” And the people kind of then go out from there in reverse order or ascending order of rank. And I think that’s a good idea because it’s a symbol of how you put the people on the front lines or closest to the front lines first, even though if it’s in a relatively modest way.

Mike Blake: [00:03:21] And as far as those of you who listen to this program know, I have a massive man crush on Simon Sinek. And I am going to find a way to get him on this podcast or get a restraining order. We’ll see which one of those things actually happens. And I’m a big fan of Start With Why. And then, I recently finished reading his book, The Infinite Game. And not necessarily explicit, but certainly implicit, The Infinite Game is about building relationships. As opposed to the traditional archetypal 20th Century and previous management model, which is really a transactional model. You do work. I pay you. We both go our separate ways. Simon Sinek, I think, is very much a thought leader in this notion of The Infinite Game that the notion of transaction based leadership is simply no longer viable in the 21st Century.

Mike Blake: [00:04:22] People are too smart. Maybe you can say people are too needy. A cynic might say, “Well, in a world of participation trophies, parenting is now being outsourced to leadership in the private world.” And that’s a little too cynic. But I can also see that point from a certain point of view. But, you know, what it really comes down to is moving from a transaction based leadership model into one that is relationship based. And there’s a limit to how much of a relationship you can have with somebody if you don’t know them. You can have a little bit of a relationship. But if you don’t actually know them, it’s really hard to take an interest in them in a way that is authentic and useful if you don’t actually know what kind of matters to people.

Mike Blake: [00:05:14] And frankly as an introvert, it’s something that I have to be very conscious of because I can be a very robotic manager without blinking an eye. Because, again, I’m a Generation X person, which means I’m a shut up, put your head down, do your work, and go home. That’s the culture I grew up in. That’s a culture I shake to – I struggle to shake. But I fully understand, I certainly make a conscious effort to evolve beyond that. And so, I hope for those of you who are like me that are looking for something useful in exchange for having, in my case, gray hair and two arthritic ankles, you know, something that goes along with the wisdom of age and that is evolving into a non-transactional form of leadership.

Mike Blake: [00:06:02] And so, I think this is going to be a great topic. And as an aside, by the way, I think it’s all that much more important because, you know, our people are – I mean, there are a lot of things right now, right? People ask me how I am and I tell them jokingly that, “Well, once you put a global once in a century pandemic, massive social upheaval, and murder hornets aside, I’m actually doing pretty well.” But imagine the slow moving horror movie that we find ourselves in. And our employees, our co-workers, our business partners, our bosses are all finding themselves in a life that is completely disrupted that overnight most of our support structures have been badly damaged or wiped out altogether. And there’s a lot of fear. There’s a lot of anger. There’s a lot of angst. There’s a lot of uncertainty. And frankly, there are just more mental demands on people.

Mike Blake: [00:07:10] And what that means to me is that, getting to know the people you work with on a personal level is more important than ever. And it’s not just because people are isolated now and they’re working at their coffee table. Yeah, there is that. But I think, also, people want to know that somebody out there kind of gives a damn about them. And in an environment where we can’t have that kind of contact we once had with our close friends and family, in some cases, it’s dangerous to interact with them. We need to pay attention to this all the more.

Mike Blake: [00:07:55] So, this is too big and complex a topic for me to cover myself. So, as we always do on this program, I brought in an expert who does know how to help us think about this. And joining us today is author and keynote speaker Alain Hunkins.

Mike Blake: [00:08:11] Alain is a leadership expert who connects the science of high performance with the performing art of leadership. Over the course of his 20 plus year career, Alain has worked with tens of thousands of leaders in over 25 countries and served clients in all industries, including 42 Fortune 100 companies. He delivers dynamic keynotes – I’ve seen them on YouTube -seminars and workshops covering a variety of leadership topics, including communication, team building, conflict management, peak performance, motivation and change.

Mike Blake: [00:08:40] He has a Master’s of Fine Arts in Acting from the University of Wisconsin- Milwaukee’s Professional Theater Training Program. Take that, all the parents who have said that kind of degree doesn’t get you anywhere. And a Bachelor of Arts from Amherst College. Alain also serves in the Faculty of Duke Corporate Education. Ranked number two worldwide in 2018 by Financial Times on this list of customized executive education programs. He has also lectured at the University of North Carolina Kenan-Flagler Business School and Columbia University.

Mike Blake: [00:09:11] Alain has authored over 400 articles that has been published by the Association for Talent Development, CEO Refresher, and the American Management Association. And he just released a book, Cracking the Leadership Code, which treats leadership as a skill set rather than a purely innate talent. And offers helpful guidance on how to develop or improve your own leadership skills. He’s a certified co-leader for ManKind Project International, a nonprofit whose mission is to help men live lives of service to their families, communities, and workplaces.

Mike Blake: [00:09:39] He is talking to us from the Netherlands today. But I also understand he hails from Northampton, Massachusetts, which is close to University of Massachusetts and the National Basketball Hall of Fame in Springfield. And I know that because I grew up about two hours away from there in Boston. I’m embarrassed to say I’ve never been to the Basketball Hall of Fame. Nevertheless, Alain, thank you for coming to the program and welcome.

Alain Hunkins: [00:10:06] Mike, thank you so much. I’m really excited to be with you here today. Thanks.

Mike Blake: [00:10:10] So, let’s jump in here with something very basic, which is when we talk about getting to know your employees on a personal level, what does that mean to you? How would we define that?

Alain Hunkins: [00:10:26] Wow. It’s a great question. And I loved your context up front was really useful. Because I think what that means has really changed over time, getting to know. So, you talked about you’re a self-identified Gen X-er, as am I. And we came of age in the business world where it’s very common. I have even heard this, like, we check your feelings at the door. And so, the idea that work and life were two separate beings.

Alain Hunkins: [00:10:49] But, you know, the world has really changed. You talked about that and just thinking about moving from this transactional based leadership to relationship based leadership. And so, what’s happening now is the fact that we, not just as employees, but just as members of society, our expectations have totally changed about what we expect from everything.

Alain Hunkins: [00:11:13] And a big part of that has to do with information technology has allowed us to be transparent, so we know what’s going on. If we don’t like our jobs, we can look in LinkedIn and Glassdoor and there are options and we can leave. So, I say all that because what it means to get to know your people is people expect more from their relationships at work than they ever have in the past. And the cool thing is we’ve had all this great social science research that shows that when people perform at their best, they’re actually feeling at their best. So, if we want our employees to do a good job, it’s actually in our best interest to make sure the environment they’re in serves that. And a big part of how that environment becomes optimal for them to perform is for them to feel good, which means they have to feel that someone cares about them.

Alain Hunkins: [00:12:06] And actually Tony Schwartz, who wrote a book called The Power of Full Engagement, and Christine Porath, who is a Georgetown professor, did this great article in The New York Times a few years ago called Why You Hate Work. And it had tons of research. And they found that actually feeling cared for is the number one thing that improves engagement and decreases turnover. So, it’s so funny because it sounds so soft and fluffy, right? “Oh, I got to care about my people. Get to know them.” There’s actually some great metrics that show there’s a lot of hard science and performance result. So, for the bottom liners, there is a lot of hard evidence for this very soft and fluffy skill. So, that’s why it’s so important to get to know your people.

Mike Blake: [00:12:56] So, a term that often enters a discussion like this and others, but we’re talking about this, is the notion of authenticity. And I’m hoping you can talk about what authenticity means in your mind and how does it enter this discussion of getting to know your employees?

Alain Hunkins: [00:13:18] Yeah. It’s a great question. You know, there’s this big hoopla around authentic. It’s like people are like, “Well, what if you’re authentically a jerk? Do I show up as an authentic jerk?” Like, “Ah. Maybe.” So, that’s not really what authenticity is about. I mean in the work context, when we think about being authentic, it’s that sense that people don’t have to wear a mask. I mean, obviously, we’re in COVID times, people are wearing physical masks. I’m talking about the psychological mask. The armor that people put on.

Alain Hunkins: [00:13:45] You know, Deloitte did this great study a few years ago and they found that 61 percent of the US employee workforce feels the need to cover their identities in some ways. They have to wear a mask. And the thing is, we all know what it’s like. We’ve all been in situations where we have to kind of put up our guard and wear a mask. And when we do that, we are disconnected both from the people around us, but in some ways from ourselves, because it takes a lot of extra energy to put on that shield.

Alain Hunkins: [00:14:14] So, authenticity is about having a relationship where people can be who they are and express what’s going on. Like, I think the idea that right now, for example, we’re going through this coronavirus pandemic. It makes sense for a leader to say, “You know, it’s okay not to be okay.” This is really tough. This is tough. These are hard times. And so, we have to normalize people’s experience because people are always looking to leaders to set the tone. And if we just pretend like it’s business as usual, deep down people are going to feel like, “Well, there’s nothing wrong. And we’re not talking about this.” And it becomes the elephant in the room.

Alain Hunkins: [00:14:55] So, authenticity is a way to address things in a way where people can drop their guard, let down their defenses, and just relax. And when they do that, the neuroscience would be it actually calms your central nervous system. And when you’re calmer, it frees up these neural resources, your brain, so you can actually focus on the job at hand instead of kind of going, “Am I okay? Is this okay? What does my boss think about me?” And all those weird thoughts that we all have all the time. So, authenticity is key to all that.

Mike Blake: [00:15:27] And, you know, that brings up another question. So, I’m going to go ahead and go off script, which by question three that means we’re on schedule. But you know, in these trying times, I think most companies are at least asking the question, how can we help our employees cope? And some things are realistically within the purview of employers to help with. And some things, frankly, just aren’t. And we cannot fix everything. We don’t have the resources. We don’t have the standing to do that. But you really can’t even begin to help employees through this. And I’m going to make this deliberately vague, whatever this is, because it’s different for everybody. You can’t begin to fix it if you don’t know them, can you?

Alain Hunkins: [00:16:13] No, you can’t. You can’t. And it’s so interesting, because as you describe this idea of fixing it, you’ve touched on such a big leadership trap, which I call – it’s actually the fixer. So, many people in organizations who are in leadership roles think, “Oh, I’m in charge. I have to fix things. I have to solve problems and make things better.” People don’t actually want to work for fixers. They want to work for leaders. And the cool thing is you don’t need to be a mind reader to figure out what’s going on. The fact is, like, for example, coronavirus pandemic. I guess we’re all in the same storm, but we’re not all in the same boat. The fact is, everyone is experiencing this. And I’ll call it a trauma because, by the way, the definition of trauma in the dictionary is a deeply distressing or disturbing experience. So, I think this qualifies, global pandemic, would you say? It’s a trauma.

Mike Blake: [00:16:58] I think so.

Alain Hunkins: [00:16:59] Yeah. I think it qualifies. Sure. So, that being said, how every single person that you work with is going to respond differently. Some people are living home and they’re alone. Other people have small kids. They have to suddenly home school and they’re now teaching on top of work. I mean, people who may be immunocompromised. They may have elderly parents. Like, we don’t know what they’re dealing with. So, the key to knowing your people isn’t to try to fix it and guess. It’s to ask them.

Alain Hunkins: [00:17:26] So, you know, I’ve been coaching a lot of leaders on this over the last few months. Like a simple question just to stop and go, “Hey. How are you? How are you feeling?” And not just, “I’m fine, how are you? Let’s get to business.” Like, “No. Really, how are you doing?” Which means as a leader, you need to park your own agenda. Put it to the side and hold space for somebody else. Now, some people are really uncomfortable because if they ask the question, how are you feeling? Guess what? If you listen, they might tell you. And some people think, “I can’t handle that.”

Alain Hunkins: [00:17:57] You know, the thing that’s really good, you don’t need to be some kind of a licensed psychologist to deal with this. All you have to be is an emphatic human. The fact is, if there are people in your life, like your family and your friends that you love and care about, you do this much more easily. Somehow, though, a lot of us have this barrier when it comes to work, when it comes to employees and asking them how they feel, that’s inappropriate. And then, they’re like, “Oh, let’s get to business.” So, yeah, it’s very much – it’s key for you to, first of all, get out of that fixer mindset.

Alain Hunkins: [00:18:26] And then second, start to listen with some purpose and have some empathy for other people’s situations. And if it turns out that what they’re dealing with is not something you can fix, just the fact that you listen and go, “I hear you. I don’t know what I can do, but I’d like to help you figure out what can get done.” That goes a long way. People get the fact that, “You know what? Ninety-five percent of our customers are gone and our business is about to close.” People get it. You know, they’re not stupid. They’re adults. And so, we have to stop treating them like their children. And a big part of that is getting to know them in their full life outside of just the functional job box that they sit in on your two dimensional industrial aged org chart.

Mike Blake: [00:19:12] And that speaks to, I think, getting out, again, of a transactional mindset. You know, getting away from – you’re not asking somebody how they are or what’s going on because that’s the necessary social protocol than to extract work. It’s a legitimate question. And I love the term empathy. I love the term empathy there.

Mike Blake: [00:19:36] And you bring up a point which I think about a lot and I want to share here, too. Is that it is scary to ask people how they’re doing because you don’t know what you’re going to get back. Right? And caring requires a certain level of courage, doesn’t it? Because once you care, you then adopt some form of ownership or responsibility. Maybe not to fix what’s going on, because that may be beyond your power. But once you do care, you do then have an obligation to share a little bit of yourself, whether it’s your time, your attention, your empathy, in order to help that person deal with whatever it is that’s going on.

Alain Hunkins: [00:20:26] Absolutely you do. Yeah. You can’t but help become invested in some way. You know, as you say that it’s funny. It reminds me, you know, we talk a big game about how important it is for employees to be engaged. You know, we’re always measuring how is our employee engagement? Well, do we ever stop and think about how is the engagement of our leaders? The fact is, as leaders, if we’re not engaged with employees, why would they be engaged with us and or at work? It doesn’t make any sense.

Alain Hunkins: [00:20:52] So, yeah, definitely you need to extend yourself to what’s going on. And yeah, you may not be comfortable with it. And this may derail your agenda. But that’s part of leadership. This is part of stepping into a role where, you know, you want to get somewhere, you have an outcome, but the map is not the territory. And somebody brings something up and suddenly this is the most important thing in this moment. Now, hopefully we’ll get back to something else, but this may take us in a different direction. And that’s being – I’ll call it mature. A mature leader to be able to do that.

Alain Hunkins: [00:21:29] And it’s funny, before you said, Mike, about the sense that, you know, some people are scared of bringing it up or they feel like there’s this protocol. The fact is, we can all smell it really quickly when someone is faking this. When someone thinks, “Oh, I have to ask you how you’re feeling, because my leadership coach told me I’m supposed to ask you that, but I really don’t care. And now that I’ve asked you that, I’m going to move on.” We all know when people are faking it. So, this does have to come from that – we’ll use that word again – authenticity that you actually genuinely care. And that is a different mindset for a lot of people. In fact, I would say that shift, which you described earlier, you know, that shift from transactional to relational may be the biggest divide that leaders have to cross to be able to do this whole caring for your people well.

Mike Blake: [00:22:14] So, let’s say that a listener now is convinced, I need to do a better job or I want to do a better job of getting to know my employees at all on a personal level or better. Is that a formal process, is it an informal process, or is it both? And I guess what I’m really getting at is, what are a couple of steps to get started once I’ve made that decision? Or if I’m going to make that decision, what are the next steps going to be?

Alain Hunkins: [00:22:42] Great question. So, I think there are some formal and there are some informal. I say on the formal side, first of all, is be intentional and make some time. Because this won’t necessarily happen in the elevator, on the water cooler, or in this case, you know, while people are just coming in waiting for the Zoom meeting to start. So, get intentional about carving out some time. The other thing I’d say on a formal point of view is, think about your structure if this helps you. Now, some people are really good at drawing people out, we call it naturally or they’ve already had some practice at it. If you’re not one of those people, you want to think about what would be some really great open-ended questions to get people talking. Because ideally they are doing 80, 85 percent of the talking and you are just asking some really good questions. And then, maybe prompting them with a tell me more. So, that’s the formal side.

Alain Hunkins: [00:23:33] On the informal side, I think it’s showing up, being present, being really open, being curious as to what they have to say, and listening with purpose. So, if I want to get to know someone, so asking a really provocative question like, “What is your biggest aspiration professionally?” That suddenly is different from, you know, “What do you want to be when you grow up?” Or, “What is really exciting to you now?” Or, “What was your biggest hobby growing up?” Or, “What was a big challenge growing up?” You know, suddenly just getting people – it sort of doesn’t matter which one you choose. Let’s face it, we all had these rich lives with incredible history. And if someone just asked us to share, tell me – or you could even say, “So, what’s your story? Tell me your story. I’d like to know more about you.”

Alain Hunkins: [00:24:23] If it’s genuine, people know it and they’ll start to open up. And if you give them the cues that you’re interested and want to hear more, they will share more. You know, I think it was Dale Carnegie in his book, How to Win Friends and Influence People who said, if you want to be interesting, be interested. And so, being interested in people – you know, we love to joke in the field that people’s favorite subject to talk about is themselves. So, you know, it’s true for customers. Why wouldn’t it be true for the people that you lead? So, taking some time upfront, thinking about intentionally how would you structure this conversation, it’s amazing. You can get more information in a half-an-hour call like this than you can otherwise.

Alain Hunkins: [00:25:07] In fact, in one of the leadership trainings I run, I actually have strangers who are confederates. We bring them in, but they’re strangers to the participants – the leader participants. And they have to basically spend a-half-an-hour engaging with a stranger. And then, we debrief the experience at the end. And one of the leaders who went through this said to me, “Oh, my gosh. I just spent 30 minutes with someone. I’m convinced I know more about this person than people who have been on my team working for me for the last five years.”

Alain Hunkins: [00:25:35] So, it’s amazing what the power of intention and the power of saying “I want to engage and get to know you” can do. You know, we like to say that,”Oh, it takes years and years to build trust.” You can accelerate that process with some good intention and some great questioning and listening skills.

Mike Blake: [00:25:55] So, how much of this also is making yourself knowable, right? And I think in that same book, Dale Carnegie talks about making it easy for people to get to know you as well. For example, in my office, I keep a music synthesizer. I almost never play it, but I keep it because it lets people know that I have a musical interest. So, if they ever wanted to ask about that, it sort of gives them an entree. And I’m big into the retro video games and I’m 50, so I’m not trying to impress anybody anymore. And I’m open about it. But I guess my point is that, how important is it also to allow yourself to be known at the same time?

Alain Hunkins: [00:26:42] It’s really important. In fact, there’s this really cool studies that have come out about this. There’s a guy named David Meerman Scott, and he’s got a book that came out about a year ago called Fanocracy. And what he discovered in his research – so, David Meerman Scott happens to be a Grateful Dead fan and he shares that whenever he does talks and workshops, he shares pictures, he talks about it. And what’s amazing is the impact is it doesn’t matter. It isn’t about what it is. It’s that he’s got an interest in something that that creates connection. So for you, it’s your synthesizer and your music in your office. It’s just like showing people that you’re not just a two dimensional worker bee. You know, people want to know that you have a life, you have interests outside. And when we do that, it actually humanizes us, it softens the edges and it creates and accelerates this power of connection. So, it’s called Fanocracy, this idea of how do you turn customers into raving fans. I think we could also say how do you turn employees into raving fans? It’s like let them know who you are.

Alain Hunkins: [00:27:45] You know, we talked earlier about the whole Gen X thing. So, 61 percent of our workforce today is Gen Y and Gen Z. And, you know, they’ve grown up in this digital world where there’s so much more transparency. I have a sister who’s 14 years younger than me and the amount of personal stuff that she posts on Facebook versus me, it’s just we’re different generations in some ways. And it’s just amazing. Because, again, she’s kind of grown up and this is what her peer group does. And they’re just so comfortable with having their world be transparent and knowing that everything is seen. I mean, this is the issue now with social media and the digital footprint is that if you say something somewhere, there’s probably a track on it. So, you’ve got to be pretty comfortable with whatever you put out there someone’s going to see somewhere.

Mike Blake: [00:28:31] So, some of our listeners may be thinking, you know, I’m already making an effort. We have our annual holiday party. We have a couple of firm events. Maybe we have an outing to a baseball game back when that wasn’t a risk your life kind of thing. But, you know, we have our spring outing or whatever. Isn’t that enough? Doesn’t that already mean I’m getting to know my employees?

Alain Hunkins: [00:28:58] Well, it’s funny, right? Yeah. We do it once a year. I mean, to me, the analogy there is a little bit – so, I’ve been married to my wife. We’re coming up on 20 years of marriage. We’ve been together 22 years. And I think the analogy I come up with it is like, so I said to her on our wedding day that I love you. Now, can I use the excuse like, “Well, I said it on our wedding day. Isn’t that good enough?” So, this idea that telling people you care about them at the annual picnic, I mean, if people care about you, wouldn’t you want them to tell you more often?

Alain Hunkins: [00:29:26] So, Gallup did this wonderful study, which they published in this book called First Break All the Rules, where they actually interviewed over a million people around the world. And they spent 20 years doing all the research to put this together. And what they found is that there’s one thing above everything else that makes for a successful employee. And they measured success by profitability, productivity, lower turnover, higher retention, stuff like that. It was what was that relationship with their immediate supervisor?

Alain Hunkins: [00:29:55] So, I would say a couple of things on this. Number one is, let’s say your – let’s just call you the CEO for now and you have 400 employees in your organization. Now, I wouldn’t expect you to get to know every single person on a deep, deep personal because it’s 400. But, hopefully, there are some layers of leadership. And so, you may have, let’s say, ten direct reports. You should really be modeling getting to know them well and being explicit about the importance of them getting to know their people well and so on and so forth. So, that’s one piece.

Alain Hunkins: [00:30:24] The other thing that the Gallup study talked about that was really useful, they turned it into these 12 questions, the Gallup 12. And one of these questions is, has someone, basically, praised me in the last seven days? Now, I’ve shared that research with people in my work. And people say, “Seven days? I’d settle for seven months.” Because some of us think, “Oh, I do it once a year. We do it on our performance review. After all, they have a job. They have a paycheck. Isn’t that motivation enough?” No, it’s not. I mean, all the studies would say, actually, money, once we get to a certain threshold, isn’t going to motivate a whole lot of performance, especially in this knowledge work economy that we live in.

Alain Hunkins: [00:31:01] You know, it might have been so if you said, “Okay. I got to produce ten widgets today. And tomorrow, if you do 12, we’ll pay you more.” But in this creative problem solving knowledge world that we live in, money is not going to be that motivator. So, yeah, getting to know people is, in fact, quite important.

Mike Blake: [00:31:20] So, now we have this relatively new dynamic. It’s not that new anymore, I guess. But for Gen X-ers like me, where the internet consisted of a 300 board modem connected to an Atari 400, it is new. But social media now comes into this, right? And I’d love to get your thoughts. I generally don’t connect with my coworkers on, say, Facebook. And really hesitate even to do it on LinkedIn. Mainly because, particularly, if they’re subordinate with me, I don’t want to feel like they – I don’t want to put them in a position of wondering if they feel like they have to connect with me because I’m higher ranked within the organization. Is that a legitimate concern or am I being overly cautious or am I not being cautious enough?

Alain Hunkins: [00:32:12] Well, Mike, what I love about your approach there is you’re not – now, I don’t know how you are. If they send you an invite, if you accept or not. So, here’s the thing, I think the point of view of, you know, there is all sorts of, we’ll call it baggage, that the leader wears along with their position, which is we have an outsized influence. So, like you’ve said, if you reach out and send a Facebook invitation to one of your direct reports like, “If I don’t accept this, what’s that going to say?” And then, suddenly they have this whole story. So, I think the strategy of if you’re in that leader role, I would wait. I would not reach out. And I would let people make the first move and be quite okay with them not. Or the other option is you are also welcome to be very explicit.

Alain Hunkins: [00:32:59] I’m a huge believer that one of the things great leaders do is they make their implicit assumptions explicit. So, if you feel comfortable, say, you know, as you are onboarding people onto your team, “Hey, I just want to let you know up front here’s my social media policy. I don’t connect. It doesn’t mean this. It doesn’t mean that. This is what it means.” And letting people know because then they’re not getting into this whole weird guessing game. You know, it’s amazing how much drama and politics goes on when people don’t have accurate information and they have to fill in the vacuum. And where we tend to fill in vacuums as humans is with negativity. So, the more you can be clear and overt and also realize you don’t want to put undue pressure on people, yeah, I wouldn’t go and start sending out friend invites to everybody because, otherwise, it’s going to put them in a very uncomfortable situation.

Mike Blake: [00:33:48] So, another question I think some of our listeners will likely have and a concern is, does getting to know your employees lead to a scenario in which you’re playing favorites? And can that – is there a risk of that interjecting kind of unwelcome politics into the workplace? And if that is a risk, what would your recommendations be on managing it?

Alain Hunkins: [00:34:15] That is a great question. So, yeah, it certainly presents a risk, this whole idea of playing favorites. So, you know, there’s a couple of things that go on the psychological level when you get to know people. So, psychologists call one of these things the similarity attraction effect, which is a fancy way for saying, “Oh, you went to the same college I did. Did you? Oh.” Like, suddenly you’re bonded. Or you have the same sports team you love. We start bonding over our shared commonalities.

Alain Hunkins: [00:34:43] So, one thing leaders should be aware of is this creates a huge unconscious bias. So, if you don’t check that and go, “Wow. I am totally wanting to spend time and promote this person because they’re so much like me. They look like me. They talk like me.” So, this is a huge thing, especially in this age where we’re trying to understand that if you want to get the best people in the best places, you want to create a diverse and inclusive workforce. And I’m not meaning just racially and socially economic. In every way, you want to create diversity and inclusion because that’s how you’re going to get the best ideas to innovate and come up with great things to move your business forward.

Alain Hunkins: [00:35:21] So, what this means is we want to be able to check our unconscious bias as best as we can, which is hard. It’s really hard to do that well. And realize that getting to know some people, am I starting to play favorites? And I think one thing that’s really valuable around this is for us, as leaders, to clarify our own values and check in with this. Because if we don’t recognize that we’re doing it, we will be doing it unconsciously and it can definitely lead to problems.

Alain Hunkins: [00:35:58] Now, one of the issues also connected to this is the idea that treating people differently actually makes sense. I’m not saying treat everyone the same, but different people are motivated by different things. And so, a big piece of effective leadership around getting to know people is different people. For example, if you want to recognize them, one person on your team, giving them a cash gift or some kind of a bonus means a lot. Somebody else, it might be doing a public thank you in front of the team or sending a note home to their family. So, you don’t want to treat everyone the same. However, the intention behind it is you want to care for people with an equal level of respect. I realize that is a bit of a subtle distinction, but this is why leadership is a lot easier to talk about than it is to do.

Mike Blake: [00:36:51] And the bias thing, that brings up kind of what I think is an interesting discussion topic, which is, I think in some cases we see employees run amok. Especially with that built-in connection, in particular, when we encounter or we observe what is now known, I guess, as the bro culture. Which is being revealed to be pretty toxic in areas of finance and areas of high growth emerging technology companies. And one of the things that I guess I struggle with, but I try to be very conscious of is that, right now the way our society is generally structured, you know, women and men have a different availability for our friendship or different availability for those kinds of of communications.

Mike Blake: [00:37:47] And to be very specific, right now in America, it is more likely still that women are bearing the bulk of the responsibility for domestic management, taking care of children, et cetera. Men, conversely, don’t necessarily have that responsibility. So, if you want to go out for drinks afterwards, men are more likely to be available than women. Women often need to or have needs that ought to be accommodated. They need to leave the office early, right? And there have been studies that have shown that that does, in fact, hurt women’s careers. And that’s something that we have to be conscious of.

Mike Blake: [00:38:31] But I think what you’re talking about that having the commonality and that bias, if you’re really not careful, it can run amok into creating a massive wedge within the organization, often in an unintended way along gender and, potentially, even racial boundaries.

Alain Hunkins: [00:38:53] Oh, completely, Mike. I mean, as you’re talking about that, that’s exactly where my mind was going to, is realizing, you know, as there has been such an awakening in the US over the last eight or so weeks since before we recorded here, thinking about all of the social unrest in the wake of the George Floyd murder. And recognizing that people are being more woken up to the fact that these biases exist. And the challenge with any kind of power dynamic bias is, in general, power tends to be blind to itself unless it gets some kind of a wake up call that says, “Hey, you should notice this because your privilege is creating these inequities.”

Alain Hunkins: [00:39:36] And for example, like you said, if I don’t stop and think, “Oh, when I invite the team out to drink, some people don’t come.” If I don’t stop to think about what that implication is and I go, “Oh. So, I’m building relationships with those people.” I need to really check – I’m doing all of that from a position of power and a position of privilege. So, it is important for me to check my position of privilege and power at the door and realize what’s the implications. Because, as you said, that can get very messy very quickly.

Mike Blake: [00:40:08] So, another concern is how do you prevent developing relationship with your employees from interfering with tough but necessary to say — but the downside of getting to know your employees as the time may come when you effectively have to fire a friend? And I fired people before. For the most part, I haven’t enjoyed it. There’s one person I couldn’t wait to see leave. I’m just going to be honest about it. That person made my life bad from start to finish. I could not wait for him to leave. So, I didn’t lose any sleep. For most part when I had to let people go, it’s a terrible day. Not as terrible as the person who’ve been let go, but it still ain’t fun.

Mike Blake: [00:40:55] And now, I’m imagining somebody who’s been through the worse and they’ve had to fire, maybe, lots of people over the years. And saying, “You know what? I don’t want to put myself in a position of potentially having to fire somebody that I care about and sees me as their friend.” Because now there’s not just a level of commercial betrayal. There’s a level, potentially, of personal betrayal. How do you work through that? How do you work through that head maze?

Alain Hunkins: [00:41:25] Yeah. There’s a lot. So, we have to unpack this a bit because there’s a lot there. So, let’s just start with, first of all, getting to know people and having to fire them in terms of – let’s just back it up for a second. One of the things I see a lot of leaders struggle with employees is, we don’t make – we talked about this earlier, about this whole mind reading thing -is we need to really clarify expectations and accountabilities upfront. Accountability is this big buzzword these days. We have to hold our people accountable.

Alain Hunkins: [00:41:57] I don’t actually think that leaders need to hold anyone accountable. I think what we need to do is clarify expectations, co-create objectives up front, set those with people, and check in with them along the way, ideally to support them. And if things start to go off track, if they’re not achieving what we have co-created and agreed upon, then I’m not really holding you accountable. I’m just reminding you of the commitments you’re making and that we’ve made. And that should be built on a foundation of honesty, openness, and trust.

Alain Hunkins: [00:42:32] And so, that’s why we can get to know each other. And if there are issues, let’s say you’re under performing in some way. So, my first take is I’m not going to wait until the end of whatever project deliverable or year performance review to come over and say, “Hey, Mike. You know, you screwed this up. And now, you better watch out because you may not have a job here.” Ideally, I would have caught that way sooner, come in and noticed where the trend is, and saying, “Hey, I just want to check in. What’s going on? Is there something that I can support you with?” Suddenly we have a different conversation. So, a big piece around accountability is co-creating those expectations.

Alain Hunkins: [00:43:07] Now, that being said, it doesn’t make it easier when you let people go when you care about them. So, I mean, to me, it’s also recognizing, you know, we tend to – and I’ll go back to what you talked about Simon Sinek and The Infinite Game. If we see a person’s career as this finite, “Okay. You’re hired. You’re fired.” And so, hired means success and fired means failure. I mean, how can we extend those relationships beyond that? So, for example, I have seen and known people who have actually walked out of a meeting getting terminated and actually feel closer to their leader than they did when they walked in, because their leader cared for them. They talked about how we can support you in this transition. They talked about how do we stay in touch and be an alumnus of this network in our organization.

Alain Hunkins: [00:43:57] So, a lot of this is the mindset. If we walk into this of, “You know, I’m firing them. I am slitting their throats.” It’s like, “No, you’re not. You’re actually terminating an employment contract. Like, let’s get clear on that.” And then, how can I – so, this has to do with being honest, straightforward, clear, and you can be empathetic. And we can all learn. And this, again, takes maturity to do all this. So, there’s a lot here. And again, easier said than done. But that’s the ideal that we’re moving towards is, how do we treat people that way? I mean, you could look at that in an analogy. You can look at that at a family system. It’s like, “Well, you know, I could care about my kids and love them, but, you know, they’re going to just move out of the house when they’re 18.”

Alain Hunkins: [00:44:40] You know, at a certain point you’ve got to invest because the investment actually pays dividends longer term. And it will pay dividends in ways you don’t even know. So, as opposed to just thinking, “Okay. Well, this is just an employee, so I’m not going to get to know them too much.” Because what you’re really doing is you’re treating them as a thing. And we’re going back to transactional world again.

Mike Blake: [00:45:04] And really what you’re describing, I think – and I’m using extreme event. It doesn’t have to be termination, but it just makes the conversation easier – is really, probably, what, I think, we consider best practices when you have to let anybody go. You would like it, again, not to be sort of the Dr. Evil kind of scenario. You push a button, the employee drops through a flaming pit. But there is actually some empathy that this is a transitional conversation. And, you know, how can I help make this easier for you, even though this is necessary?

Mike Blake: [00:45:40] You know, in a way, getting to know the employees, I think, if you follow that thesis to the conclusion here, it’s really nudging you in a way that you probably want to go and you probably want to have yourself viewed as a leader and as a company to other prospective employees down the road, right?

Alain Hunkins: [00:46:02] Totally. Totally. I mean, if you think about it, the natural extension of getting to know your people is, “Now that I know them, if it comes time for us to part ways, I’ll be in a much better position to part ways in a more effective, we’ll call win-win situation than we would otherwise.” Because otherwise, it’s much more transactional and much more Dr. Evil less. So, that’s what we can do. And so, by being a kind of leader that cares about people, you’re in a much better situation and you know so much more, so you can make better decisions as you move forward.

Mike Blake: [00:46:38] But I got to be careful using Dr. Evil because there are going to be millennials and Gen Y who have no idea who Dr. Evil is. So, anyway, look it up on YouTube, or Instagram, or TikTok, or whatever it is you’re doing. So, a question I’ve got to get to – and we’re wrapping up. I want to be respectful of your time, especially where you are, it’s approaching dinnertime. But the elephant in the room here – and we’re saving the best for last – is what is the danger of a romantic relationship? Or I’m not sure if it’s worse, but at least equally bad, a romantic feeling that is not reciprocated arising from getting to know your employees better.

Mike Blake: [00:47:29] It’s a natural danger that, you know, intimacy can lead then to desires for other things. I think we both agree can be, in my view, personally, I think are very likely to be enormously destructive. How do you put up a firewall to minimize the likelihood of something like that occurring?

Alain Hunkins: [00:47:55] Oh, my gosh. What a good juicy question we have here. Yes. So this is a big one because, let’s face it, we’re human. And, you know, there’s lots going on. So, one of the things is, first of all, if you’re in a position of leadership in an organization – this probably varies from state to state and even organization – first of all, check your policies first. Like, see what’s legitimate and legal in terms of your organizational policies and all that first. And get really clear on that before any of this stuff happens. Just find it out first, do me a favor, please.

Alain Hunkins: [00:48:27] And then, in terms of that, yeah, for certain, if you are in the leadership role, again, there is a power dynamic. Even though we don’t talk about it, it’s there. And I think that you have to proceed with huge caution around moving forward anyway because of that power dynamic going on. So, again, kind of like you talked about before – let’s assume that the policy is it’s okay. I would say, like we talk with social media, if I’m in a position of power, I do not think it is appropriate for me to initiate any of this. And I would backtrack as much as possible. Like, I wouldn’t send a friend invite, the same thing, because that’s going on.

Alain Hunkins: [00:49:13] Now, you also talked about the sense of what if it’s not reciprocated? I mean, this is where we get into dicier waters, right? So, you want to maintain professional boundaries. That being said, many people in the world have met who ends up becoming their partner/spouse in a work context. It’s going to happen. But I think underneath the principle we’re talking about is being intentional, being conscious, checking your biases, and being respectful of the other person at all times. I think that’s a good rule of thumb to proceed, but also check your policies.

Mike Blake: [00:49:52] You know, and I think that brings to mind a theme that then, I think, recurs is, make sure you’re authentic and you have the right motivation for initiating the get to know you better kind of relationship, the friendship. Because part of the issue with the power dynamic of romance is that, I think, in many cases that does revert back to a transactional space. And I think one of the ways that, at least, a nominally well-intentioned effort to get to know your employees better can be perverted is to then adopt a view that while this is going to become transactional, there’s something that I can extract out of this. And boy, that is sticking your fork in a plugged in toaster standing in a bathtub full of water, isn’t it?

Alain Hunkins: [00:50:53] Totally. It totally is. And, you know, you talked about the sense of, you know, where caring for your people might start to cross the line. We’ve got to be clear, there’s caring for people and that doesn’t necessarily mean intimate caring. There’s a big difference. Just in the same way that I can tell someone that I love them. I have coworkers and I say I love you all. You know, this is totally platonic love. It’s not like I love you and now let’s go and get married.

Alain Hunkins: [00:51:20] Love, there’s a difference. And, you know, part of this is having the wisdom to be able to say that and understand it and to live that. And this goes back to, like you said, the authenticity and the clarity of your purpose and what your intentions are behind it. And people can tell – you know, people smell out intentions pretty well. So, it’s important for us to smell out our own intentions first.

Mike Blake: [00:51:41] And if you can’t handle that, then maybe it makes sense that maybe you dial it back, right? You may not be emotionally wired to engage in a productive relationship. And that may require some kind of psychotherapy or reflection or spirituality to help you kind of work through. But, you know, if in your own self-assessment, you say, “You know what? I just can’t.” Maybe you even have a history. Once I start that relationship, I’m kind of all or nothing. But that may be a situation where if it’s really all or nothing, then maybe nothing is actually better.

Alain Hunkins: [00:52:19] Yeah, for sure. You bring up such a good point here around this whole sense. Because, you know, different people learn about how you develop romantic relationships from a lot of different role models. And some of those role models are healthy and a lot are not healthy. So, we need to kind of check out, like, where am I coming from? And of course, the problem with this is when you’re in a leadership role in an organization, you now have a position of privilege. And people are going to project onto you. It’s like, “Oh, you’re an executive vice president. You’ve got your stuff together and all these other things.” Well, maybe that person has actually gotten some emotional arrested development around relationship building skills when it comes to romance. And suddenly that lack of maturity is now acting out all over the place.

Alain Hunkins: [00:53:01] So, this is why it’s so important, as you said, for us to go back and understand where we’re coming from. So, that’s why we talked about leadership development and personal development. The fact is the two are totally inextricably linked. You can’t really do one without the other because the person is the leader and the leader is the person.

Mike Blake: [00:53:21] So, Alain, this has been a terrific conversation, frankly, even better than than I had hoped. I think we’re already setting a record for the longest podcast we’ve ever done. So, thank you for putting up with that. And I have nine more questions I could ask. But how could people contact you if they want to learn more about this topic, maybe open a dialogue with you, get a quick piece of advice, something like that?

Alain Hunkins: [00:53:46] Yeah, sure thing. So, easiest place to find me is my website, which is www.alainhunkins. I’m going to spell that because it’s a French name. Alain, A-L-A-I-N-H-U-N-K-I-N-S.com. A lot of my thinking is actually been captured in my book, Cracking the Leadership Code. There’s a link to it on my website. You can also go to crackingtheleadershipcode.com and preview the book, download a chapter. And you can also connect with me on LinkedIn. I’m pretty active on that platform. But you won’t find me on Instagram because I’m an old Gen X-er who doesn’t do that as my 13 year old daughter reminds me of all the time.

Mike Blake: [00:54:24] Well, that’s going to wrap it up for today’s program. And I’ll haul out my French degrees and pronounce it properly. So, I like to thank Alain Hunkins so much for joining us and sharing his expertise with us today.

Mike Blake: [00:54:35] We’ll be exploring a new topic each week, so please tune in so that when you’re faced with your next executive decision, you have clear vision when making it. If you enjoy these podcasts, please consider leaving a review with your favorite podcast aggregator. It helps people find us that we can help them. Once again, this is Mike Blake. Our sponsor is Brady Ware & Company. And this has been the Decision Vision podcast.

Decision Vision Episode 77: Should I Get to Know my Employees on a Personal Level? – An Interview with Alain Hunkins

Decision Vision Episode 77: Should I Get to Know my Employees on a Personal Level? – An Interview with Alain Hunkins