Brad Taylor, Taylor Built Brands (North Fulton Business Radio, Episode 247)

Brad Taylor joined the show to discuss brand positioning and other key branding principles for both B2C and B2B companies. Speaking with host John Ray, Brad also discussed his sales management and consulting services. “North Fulton Business Radio” is produced virtually by the North Fulton studio of Business RadioX® in Alpharetta.

Brad Taylor, Founder and CEO, Taylor Built Brands

Taylor Built Brands is a branding, marketing, and sales strategy consultancy based in Roswell. The founder, Brad Taylor, is a 30-yr sales/marketing veteran and spent the last 24 years in Marketing and Sales leadership roles at The Coca-Cola Co. Prior to that, he gained valuable marketing experience at Pizza Hut, Inc. and in the advertising agency industry.

Brad has been thoroughly trained, and has vast experience in consulting on all aspects of Brand Development/Management, Digital Marketing, and Sales Management/Business Development. He is widely known as an “out-of-the-box” thinker and extremely easy to do business with. In addition to consulting small businesses, Brad also teaches Branding and Marketing classes at Emory University and KSU.

Points of Contact for Brad Taylor:

LinkedIn URL: https://www.linkedin.com/in/bradalantaylor/

Facebook URL: https://www.facebook.com/BmktgTaylor

Twitter URL: https://twitter.com/bcoketaylor

Instagram URL: https://www.instagram.com/bcoketaylor/

Questions/Topics Discussed in this Show

1. Why did you start Taylor Built Brands and what services do you provide?

2. Who is the target customer for Taylor Built Brands?

3. How can Taylor Built Brands help local firms grow their business?

4. What is Brand Positioning and why is it so important for businesses to focus on that?

5. What other ways can Taylor Built Brands help firms grow their business?

6. What do you do when you’re not consulting local businesses?

North Fulton Business Radio” is produced virtually from the North Fulton studio of Business RadioX® in Alpharetta. You can find the full archive of shows by following this link. The show is available on all the major podcast apps, including Apple Podcasts, Spotify, Google, iHeart Radio, Stitcher, TuneIn, and others.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has grown to become one of the Southeast’s strongest financial institutions with over $13 billion in assets and more than 190 banking, lending, wealth management and financial services offices in Mississippi, Alabama, Tennessee, Georgia and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

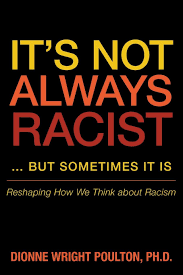

Additionally, Dr. Poulton is author of the acclaimed book,

Additionally, Dr. Poulton is author of the acclaimed book,

Inspiring Women, Episode 22: Silencing Your Self Doubt

Inspiring Women, Episode 22: Silencing Your Self Doubt