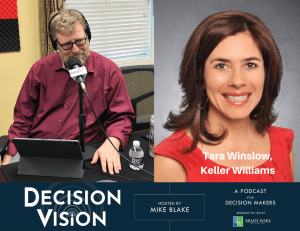

Decision Vision Episode 68: Should I Invest in Real Estate? – An Interview with Tara Winslow, Keller Williams

As an individual, should I invest in real estate? How does the Covid-19 environment change anythign? Real estate authority Tara Winslow joins “Decision Vision” to discuss these questions and much more with your host, Mike Blake. “Decision Vision” is presented by Brady Ware & Company. (Listener note: “Decision Vision” normally covers questions related to the business itself. This episode covers personal real estate investment. If you’re interested in the question of whether your business should purchase real estate, go to Decision Vision Episode 43.)

Tara Winslow, Keller Williams

Tara Winslow is a real estate agent with Keller Williams Realty. As a native Atlantan, she has vast insight into the Atlanta real estate market. Tara works from the Keller Williams Realty Peachtree Road office in Brookhaven. Her office has sold over $1 Billion every year since 2015 and is ranked as the top realty company in Atlanta. She loves being a business owner, which allows her to help make decisions important to her clients. Tara is committed to her clients, values long-term relationships and strives to exceed expectations. She has a deep understanding of the real estate process and knows what it takes to get her clients into the home of their dreams. Tara takes pride in her business and earns the trust of her clients who call on her for advice.

For more information on Tara, go to https://www.tarawinslowhomes.com/, or you can email her directly.

Michael Blake, Brady Ware & Company

Michael Blake is Host of the “Decision Vision” podcast series and a Director of Brady Ware & Company. Mike specializes in the valuation of intellectual property-driven firms, such as software firms, aerospace firms and professional services firms, most frequently in the capacity as a transaction advisor, helping clients obtain great outcomes from complex transaction opportunities. He is also a specialist in the appraisal of intellectual properties as stand-alone assets, such as software, trade secrets, and patents.

Mike has been a full-time business appraiser for 13 years with public accounting firms, boutique business appraisal firms, and an owner of his own firm. Prior to that, he spent 8 years in venture capital and investment banking, including transactions in the U.S., Israel, Russia, Ukraine, and Belarus.

Brady Ware & Company

Brady Ware & Company is a regional full-service accounting and advisory firm which helps businesses and entrepreneurs make visions a reality. Brady Ware services clients nationally from its offices in Alpharetta, GA; Columbus and Dayton, OH; and Richmond, IN. The firm is growth minded, committed to the regions in which they operate, and most importantly, they make significant investments in their people and service offerings to meet the changing financial needs of those they are privileged to serve. The firm is dedicated to providing results that make a difference for its clients.

Decision Vision Podcast Series

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at decisionvision@bradyware.com and make sure to listen to every Thursday to the “Decision Vision” podcast. Past episodes of “Decision Vision” can be found here. “Decision Vision” is produced and broadcast by the North Fulton studio of Business RadioX®.

Visit Brady Ware & Company on social media:

LinkedIn: https://www.linkedin.com/company/brady-ware/

Facebook: https://www.facebook.com/bradywareCPAs/

Twitter: https://twitter.com/BradyWare

Instagram: https://www.instagram.com/bradywarecompany/

Show Transcript

Intro: Welcome to Decision Vision, a podcast series focusing on critical business decisions brought to you by Brady Ware & Company. Brady Ware is a regional, full-service accounting and advisory firm that helps businesses and entrepreneurs make visions a reality?

Mike Blake: And welcome to Decision Vision, a podcast giving you, the listener, clear vision to make great decisions. In each episode, we discuss the process of decision making on a different topic from the business owners’ or executives’ perspective. We aren’t necessarily telling you what to do, but we can put you in a position to make an informed decision on your own and understand when you might need help along the way.

Mike Blake: My name is Mike Blake and I’m your host for today’s program. I’m a director at Brady Ware & Company, a full-service accounting firm based in Dayton, Ohio, with offices in Dayton; Columbus, Ohio; Richmond, Indiana; and Alpharetta, Georgia. Brady Ware is sponsoring this podcast, which is being recorded in Atlanta per social distancing protocols. If you like this podcast, please subscribe on your favorite podcast aggregator and please consider leaving a review of the podcast as well.

Mike Blake: So, the topic we’re discussing today, the decision we’re discussing today is, should I invest in real estate? And full disclosure, but I’m not a real estate guy. You know, I do business appraisals for a living. And, you know, we know our cousins who do real estate appraisals for a living, but the two really don’t meet. They’re separate. They’re related, but very much separate disciplines. And all candor, I’m not even a very good monopoly player.

Mike Blake: My kids kicked my ass all the time, and really, are not very good winners about it either. I did not know my 18-year-old could dance so much as to when I land on his hotel on Boardwalk, which I think is a bad neighborhood, by the way, but whatever. So, real estate to me has always had something of a mystique to it. And you almost can’t get away from real estate in a certain perspective. You know, I think particularly in America, a lot of people are enamored of real estate.

Mike Blake: Of course, our president made his fortune in real estate before he became a reality TV star, and then 45th president of the United States. And, you know, I do hear from time to time from people that have either invested in real estate or they’re thinking of investing in real estate. A lot of the work that I do involves the appraisal, what’s called a real estate limited partnership, which is a vehicle where usually, a family, but often as well, multiple individuals invest in a particular vehicle. That vehicle is a holding entity for a real estate.

Mike Blake: And then, sometimes, that shares or that entity are then gifted or left via a state to future generations. And there are certain tax advantages to doing it that way. As I’ve said many times in this podcast, I’m not a CPA. I’m not going to opine on what’s a good tax thing to do or not, except I think you should pay them if you owe them. But beyond that, I’m not comfortable offering any advice. And we’ve talked about real estate on this program before.

Mike Blake: We’ve had people come on and talk about, you know, what does commercial real estate from an operational perspective look like in a coronavirus world, right? I think a lot of us are starting to come to the realization that real estate is going to be different. I really don’t know if we’re going to need more real estate because we now need to have about 50 feet in between people inside the office, or if it’s going to be less because nobody is going to come into the office at all because we think it’s basically a virus-driven kill box, or if it’s going to be somewhere in between. I truly don’t know.

Mike Blake: And if you do know, you know, feel free to send us an email and and give us your view on that. And then, we’ve also had another podcast, which I really enjoyed, where we had an expert come on and talk about whether a business should buy its own real estate. And that’s a question I am asked frequently. You know, I’ve got a business, and in some cases, I’m going to raise money to buy my own real estate because, you know, even if the business sort of goes completely, at least the real estate asset is there that may appreciate sort of as a form on value.

Mike Blake: And, you know, one of the things we talked about there is and the conclusions that we drew is, you know, unless you want real estate management to become a core part of your business, you know, just keep renting. It isn’t necessarily all that and a bag of chips. And I imagine right now, if you did pull the trigger and bought real estate for your own business and, you know, you may be wondering about that decision, especially if you’ve had to lay people off, as many companies have to do.

Mike Blake: And as we record this today, the most recent unemployment report shows that we’re at 14.5%, which frankly is better than I thought it would be. So, I guess I’m the eternal pessimist. But we’re going to look at real estate from a different angle, which is from more of a personal investment perspective. And this is breaking a little bit from tradition in terms of what we normally do on Decision Vision because we typically look at a flat-out hardcore business decision.

Mike Blake: But, you know, at the same token, owners and executives do have their own portfolios. They are looking at investing in real estate. And quite frankly, you know, as we record this on May the 8th, and happy VE Day, by the way, you know, I think everybody is at least thinking about their portfolio. They’re thinking about risk. They’re thinking about diversification. You know, just as we went through the roller coaster ride back in ’08 and ’09 with our 401(k)s and our investment portfolios, you know, we’re doing that now as well.

Mike Blake: Maybe the barf bag is even bigger for this ride. It really kind of remains to be seen where we’re going to end up. And I think it’s natural to kind of think about where does real estate factor into this, right? You know, worst comes to worst, at least, you know, I own something. And, you know, unless you own beachfront property somewhere in Florida, you know, that land is never going away. So, I hope you’ll find that it’s an interesting topic, even though I’m being a little bit indulgent on the topic.

Mike Blake: But, you know, if you’re an executive, if you’re a business owner, you have a portfolio, I think a lot of you are already thinking about this. So, as I said, it was not really through any false modesty, as a reporting of fact, I am not a real estate guy. I don’t know anything about it. And as you know, as is the format for our show, we bring on somebody who actually does know what they’re talking about. And joining us today is my friend Tara Winslow, who is a realtor with Keller Williams. As a native Atlantan, and believe it or not, they actually do exist, they are not urban legends, she has vast insight into Atlanta real estate market.

Mike Blake: She has her practice at Keller Williams Realty piece. She wrote office in Brookhaven, which is about two-and-a-half miles down the street from where I’m recording today. Her office has sold over one billion dollars every year since 2015 and holds the number one realty company standing in Atlanta. She loves being a business owner, which allows her to help make decisions important to her clients. There’s that decision connection again. Tara is committed to her clients, values long-term relationships, and strives to exceed expectations.

Mike Blake: She has a deep understanding of the real estate process and knows what it takes to get her clients into the home of their dreams. Tara takes pride in her business, and there is a trust of her clients who are calling her for advice. And she and I met originally about two years ago. And I’m normally a very hard person to get along with, but I have to tell you, I took an instant liking to Tara, which is rare. I normally take an instant disliking to most people. So, it is a delight and a privilege to have her on the program. Tara, thanks for joining us today.

Tara Winslow: Thank you so much, Mike. I appreciate it and thankful that you invited me as a guest.

Mike Blake: So, I guess, you know, before we get started, I mean, how are you holding up sort of living in a slow-moving B horror show?

Tara Winslow: Well, you know, real estate is still moving pretty quickly. So, contrary to what you might see in the news, we are still doing business. Buyers, and sellers, and investors are out there every day seeing properties. So, things are going really great. And, you know, we’re just balancing working from home like everybody else, and having kids at home, and doing the best that we can in both areas.

Mike Blake: You know, it’s interesting, you mentioned that real estate is still moving. Just about the time when my community of Chamblee, Georgia decided to go on lockdown, pretty much following the rest of DeKalb County, you know, our neighbors put their house up for sale. And my wife and I kind of looked at each other, said, “Really? I’m not sure this is the time when people are necessarily buying.” And true to my preamble here that I know nothing about real estate, the darn thing is sold within three days, and had sold for a price that I was jumping for joy because our house is much larger than theirs, so we’re doing all right.

Mike Blake: But if you’re a tax assessor for DeKalb County, I didn’t mean any of that. So, clearly, you know, there’s still a market out there. And, you know, now that you mention it, let’s get into—I’m just going to go off script right away because I know you can catch up to a curve ball. So, why is it? Why is a lot of the rest of the world, sort of freeze thing in place, the day the world’s stood still, and real estate is chugging along? Why did that house next to us sell for a pretty good sum, and quickly?

Tara Winslow: Yeah, that’s a great question. And just to let you know, I’ve been tracking the statistics, which I’m a very fact-based realtor. And I’ve been tracking the statistics since March 22nd. So, looking at the new listings that went on the market in Metro Atlanta yesterday, within a 24-hour period, you’re looking at 525 or sellers deciding to put their house on the market yesterday. And for some reason, people are still continuing to transition.

Tara Winslow: You know, those transitions in life continue. You’re still getting married, some now virtually online. Many people are doing that. Divorces, children, you’re having more children. And while we’re sitting at home quarantining, I mean, how many Facebook posts have you seen about people wishing they had a pool, or wishing they had that office, or wishing they had a basement to send their kids down there, you know. So, people’s minds are really turning over real estate and it continues.

Mike Blake: Yeah. And I’m curious, too, because one of the things that I’ve observed in the real estate market, in particular, on residential, is historically, there’s been a lack of properties for sale, right? That’s been a big issue holding up the market and particularly starter properties.

Tara Winslow: Yes.

Mike Blake: Now, I kind of wonder if, and maybe this is this is partially profiting off of the misfortune of others, but you have to talk about the elephant in the room. Is there, is there more inventory now coming into the system because people are having to rethink their own housing because their income situation has changed or is it largely driven by what you just said, is that man, if I spend another day in this 2,200 square foot or this 1,500 square foot house with my kids, it’s going to be this deal, where four go out and two come back kind of thing?

Tara Winslow: Yeah. And I think there isn’t really a hard black or white answer on this one. There’s still a shortage of inventory. We have a plethora of buyers on the sidelines right now waiting to pull the trigger. And it’s happening every day. I have three buyers that went under contract just this week alone. So, I don’t know if there’s like one specific end-all-be-all answer, but we do still have a shortage of inventory, at least speaking from the Atlanta market and the millions of people that are moving into Atlanta over the next couple of years. You know, the home affordability is a whole different topic you may want to consider down the road because people are having to move further out on the outskirts of Atlanta to afford a house.

Mike Blake: Yeah. And again, I promise we’ll eventually get to the questions that I have to ask, but we’ve jumped into such an interesting topic. I can’t let go of it, you know. And that whole dynamic of distance sounds like it’s going to change, right? Fewer people are going to need to commute. Fewer people are going to want to commute, right? I don’t know what Atlanta has decided or is deciding, but I have read that other large cities are effectively shutting down their mass transit systems, right? Because every bus is going to basically be a COVID incubator on wheels, right? And the same thing for subway, right? So, commuting is not going to be realistic, which means that people can perhaps explore moving farther away from the city center than they might have done four months ago. And I can see you nodding, nobody else can, but it sounds like there may be something to that.

Tara Winslow: Yeah. I mean, you know, look up north in Forsyth County. People are moving in droves in Forsyth County. I had a listing there. We had over 11 showings in two days and multiple contracts. So, you get a great big house there for a regular-sized family, finished basement for a great price. And you have some space in the backyard. I mean, it’s booming there and they continue to build. New construction continues all over around Atlanta. So, I think that’s-

Mike Blake: Eleven showings in two days.

Tara Winslow: Yeah.

Mike Blake: And then, how long did it take to get a contract in that house or is it still pending?

Tara Winslow: Well, you know, I was the listing agent, I was stalling a little bit because I was waiting to see what kind of offers were going to come in to best represent my seller. We would go contract within 24 hours, but we let it go a little bit longer to maximize my seller’s return.

Mike Blake: Good for you and good for your client.

Tara Winslow: Yeah.

Mike Blake: Okay. So, let’s then jump in. I think that’s a really good, helpful background.

Tara Winslow: And you mentioned the commercial market.

Mike Blake: Yeah.

Tara Winslow: You know, I have friends in commercial real estate. And when you talk about commercial real estate and residential, there are really two different entities going on. And what the effects that are happening to both of those are very different. And I think you mentioned when you began speaking about commercial real estate, is really seen—I mean, they’re taking a hit right now. So, I just wanted to kind of confirm also what you are saying about that.

Mike Blake: Yeah. Let’s come back to that because of my understanding that that is an important distinction. But before we get there, let’s talk about what makes real estate special. You know, I’ve been fortunate. I’ve traveled abroad. I’ve lived abroad. I’ve never been any place in the world where real estate sort of has this romance to it, as in the United States. And, you know, it still seems to be a notion that you’ve “made it” if you’re a real estate owner. And do you agree with that observation? If you do, why do you think that is?

Tara Winslow: Goodness. Great question. You know, I think it allows people to think and dream about the life that they want. And I was just talking to a potential client yesterday, and he’s looking in a specific area up to 1.6, and you know what he says to me yesterday? He’s like, I’m not even going to go up to 1.6. I’m at 1.2, but I’m just looking at these beautiful homes, and thinking about my lifestyle, and how that would work. And I think it’s really therapeutic.

Tara Winslow: And particularly right now in the world that we live in, when you’re dealing with challenges, people want to look online, and envision their life in a new city or a new country, and doing something different. And I think that that’s part of the mystique and the edge that pulls you in. And I also think it releases dopamine in your head when you’re doing that, you know, and it stimulates the habit of wanting to go back and get that good feeling.

Mike Blake: So, you know, I’m thinking about looking at real estate as an investment perspective and, you know, owning a physical property as an investor. How does somebody like you help me get started? And is that process a little different from the process of trying to find a piece of real estate that I actually plan to live in?

Tara Winslow: Yeah. You know, from an investing standpoint, the end-all, be-all is what you want to achieve. So, what is your goal when you’re investing? And that’s really the big question that needs to be answered upfront. And during our consultation together, we really need to ferret out what your end game is. And that’s going to take us down different avenues of where you want to go in terms of, do you want to buy, fix, sell? Do you want to buy, fix, hold? Do you want to buy, fix, rent? So, what and how long are you going to be doing this? What are you going to be using the funds for down the road? Is it going to be for your kid’s college tuition in 15 years, if you have a three-year-old? So, it’s really important to kind of nail down and get clarity around what the end game is.

Mike Blake: And, you know, is all real estate alike? I mean, there is real estate that’s residential, there’s real estate that’s commercial, there’s real estate that’s industrial. You know, can you lump that all in or do each of those have like a different market, a different model, and maybe a different suitability from an investment standpoint?

Tara Winslow: Yeah, I mean, for me, you specialize in something, they come to you because you specialize in what you do and you’re great at it. And someone who specializes in residential real estate, like myself, I don’t specialize in commercial real estate. And I have plenty of commercial partners to refer my clients and friends to, which I do, because, you know, I don’t think that you can represent someone to the best of your ability if you don’t specialize in it and commercial gets broken out into so many different areas.

Tara Winslow: Are you wanting to purchase land? Are you wanting to purchase a physical entity? Are you wanting to lease office space? So, even within commercial, when I talk to my partners, they all specialize in certain areas of commercial. And I think it’s important for the person considering one or the other, commercial or residential, to really make sure you have a specialist in that field.

Mike Blake: Now, even in residential real estate, there are certain distinctions, right? I understand there’s a distinction, for example, from single-family to multifamily residential as well. Is that distinction important? By multifamily, I think that means you’re buying an apartment building, basically, or condo building with multiple families in it, maybe something else, too. Is that an important distinction?

Tara Winslow: I think it is because if you’re buying an apartment building, you’re going to be renting it to tenants. And you need to have that experience and look at the different rates of return, what your investment is, what are you going to be getting from a rental standpoint? So, I do think that they’re very different. And then, you know, single family, then you have condos and townhouses.

Tara Winslow: So, you have attached living and you have detached living. And then, you have HOA, you know, fees, Homeowners Association fees in some, and not at all. So, there’s a lot of different distinctions going on. And you do learn about all these things in your career, you know, over time. So, it just depends, again, what person, what your client’s wanting to do, and what their expectations are.

Mike Blake: So, I think there’s a perception that investing in real estate is for big shots, right? You’ve already got to be sitting on a pile of cash. If I’m going to make a real estate investment again, not my home, we’ll get to the home as investment in a little while, but I think there’s a perception, well, I bet I need to be sitting on a pile of cash, 100, 200 million dollars before I even think about undertaking a real estate investment. Is that true? And if so, is there a minimum threshold? And if not, then what is kind of the financial threshold where somebody can realistically start thinking about becoming a real estate investor?

Tara Winslow: Yeah. I mean, I think that many people make themselves wealthy and they have financial wealth when they invest in real estate. And if you look at some of the big people, for instance, Gary Keller, who is the CEO and founder of my company, Keller Williams, he wasn’t where he was today when he first invested. And typically, it’s a lot of people who want to follow a process, and a system, and make money. And they know that right now, they need to be doing a little bit at a time to have this really big portion of real estate and wealth.

Tara Winslow: So, do I think that you can invest and you have to be wealthy and have a ton of cash? I think that that’s maybe more of a myth understanding than being able to really sit down, again, and line up—where are your avenues to get different things? And maybe you have a private lender or you have someone you can get a loan from. There are a lot of different methods. Maybe you can put something on a credit card temporarily until you get a tenant in there.

Tara Winslow: So, you don’t need a big down payment right now. In lending, Mike, who you choose as a lender is also very critical. There are a lot of lenders that specifically work with investors that can help you tremendously and offer different packages to you. So, again, it’s really using a resource and finding that specialist who can open, you know, their contacts to where you want to go and you help them get there. And it can absolutely happen.

Mike Blake: Well, let’s talk about that because I think the lending part, I mean, I don’t think you can talk about real estate without talking about the lending environment, right? Because that’s typically how these things are capitalized. And it’s such a multidimensional question, we’ll spend some time on this. I guess, first, are banks typically real estate investment lenders or is it going to be somebody that’s in the non-traditional, non-depository market that typically is going to provide the capital for a real estate investment?

Tara Winslow: Well, when I hear banks, I think of Bank of America, Wells Fargo, Chase. When you use that word, is that what you’re thinking?

Mike Blake: Well, I mean, it could be. But, you know, you and I are both aware there are smaller banks as well and community banks can be a little bit more cuddly, a little bit more user-friendly. I think we’ve certainly found that through the whole PPP exercise. You know, you’re much more likely to successfully secure a loan through a smaller community bank than you are, a larger bank. So, I’m going to deliberately leave that open-ended. And maybe your question has two answers depending on the kind of bank.

Tara Winslow: I agree. Definitely. There are a lot of local lenders here. I have several to suggest to my clients who, all they do is mortgage lending. So, they have different programs and each lender has a different program or specializes in different programs. And again, it may be that you need to talk to two or three to kind of tell them what your plan is and see if their program fits best for you.

Tara Winslow: But they are lending. And I get updates. We are on calls every week with our lender that is in our office and they are updating us weekly on the different trends, what they’re hearing, what they can still offer. And right now, they are offering all of their packages and offerings, are still the same. They have not changed like the traditional bigger banks. They have tightened up their belts.

Mike Blake: Now, I think that’s worth underscoring. And that’s a big difference. For those of us who are old enough to remember the ’08 and ’09 recession, that was a balance sheet recession. And the banks basically just slammed on the brakes and some of them didn’t slam on the brakes quickly enough, and they fell over the cliff, right? And so, for a while, you just could not get a loan, frankly, unless you didn’t need one, right?

Mike Blake: And even then, it was difficult. It seems to me like that part of it at least is a little bit different. My own analysis, the banks are in much better shape now than they were 10, 12 years ago. They have just turned a lot of fees by processing this PPP program. So, that has helped them capitalize as well. So, it does seem like that the banks are more open for business than we might expect. Sounds like you think the same, you see the same thing?

Tara Winslow: Yeah, I think so. Yeah. I totally agree with what you just said. I think that they’re ready to do business and they’re moving as business as usual.

Mike Blake: And how are they reacting? And we’re recording this on May 8th. And we are in a very strange economic environment, where, frankly, the Federal Reserve is doing things that when I was getting my economics degree, said that we were basically to blow up the planet. And the planet has not blown up yet, but we do have interest rates that in some cases are at double-take loans, like, really, it’s that low, right? I did not think I’d ever refinance my mortgage again because I thought I had such a great rate, and yet, here I am. But also, I’m hearing that that’s not necessarily kind of uniform and it’s kind of bumpy. How is the interest rate environment being reflected in bank’s willingness in terms of lending right now?

Tara Winslow: Well, from a high-level, because I always lean on my lending partners to really get into the guts of the lending piece of it, but from a high level, historically low interest rates is what is continuing to keep people, buyers, in the game and ready to go. And the forecasting that I’ve been hearing is that they will continue to stay fairly low, at least through the end of the year, is what I’m hearing from a forecast standpoint, which is great for people to continue to take advantage of these rates. Just think how much equity you already have when you purchase something five, 10 years down the road with this interest rate that you’re going to get today.

Mike Blake: Well, that’s right. And that’s the attractive, anytime you can borrow money, right? By simply surviving another month, you add value, basically.

Tara Winslow: Yeah.

Mike Blake: And I haven’t exactly done—and of course, depends on the length of the mortgage, too. But, you know, if it’s a 15-year mortgage, you’re hitting that inflection point pretty quickly where you’re paying more principal rather than interest, right? And then, every month, that’s just survive and advance. Every month you make a payment, you’re adding—regardless of what the markets or almost regardless, you’re adding more value.

Tara Winslow: Yeah. And if you rent out your home-

Mike Blake: Like a savings account with somebody else’s money.

Tara Winslow: Yeah. Right. And if you’re renting your investment, then someone’s paying your mortgage. So, it’s kind of a double—you’re getting like a two-things-for-one here.

Mike Blake: So, we hear a lot about the notion that somebody’s home is their investment, right? And I’m curious, I’ve been reading a lot, and I know if you’ve seen the same thing, but I’ve read more than I’ve ever recalled reading in my lifetime, where the notion of the home being an investment is now being challenged, where commentators, I don’t know if they’re experts or not, they’re published in places, their position is kind of experts, but I’m just calling them commentators because I can say that safely and factually, where they’re saying, well, you know, you might actually be better off continuing to rent.

Mike Blake: And then, you know, whatever you’re saving in terms of home taxes, and maintenance, and so forth, you know, just invest that in the stock market or invest that in publicly-traded real estate holding companies, something like that. I imagine you have a viewpoint on that. I’m sure you’ve heard that argument before. So, let me open the microphone here, and step back, and let you kind of respond to that.

Tara Winslow: There are so many responses in your loaded question. From our renting perspective, I don’t see any benefit to a person continuing to rent if you can buy a home. Rental rates in Atlanta continue to increase. So, if you want to live in Midtown and you’re paying $2,500 a month in rent for to pay off someone else’s investment, it just seems crazy to me to do that. Why not build your own wealth? You have an opportunity to build your own wealth for you and your family and whoever you want to leave your investments to. So, that’s one thing that comes to my mind. And you mentioned there was kind of a second piece of what you are asking.

Mike Blake: It’s about whether or not you’re simply better off. There are sort of, I guess, not hidden, but there are ancillary costs of homeownership, right? There are taxes. There is, you know, maintenance and upkeep. Things break, you got to fix, you got to maintain, so forth. And maybe in some cases, you know, instead of taking on the called burden of homeownership, you’re better off taking some of that money and simply generating return by investing in the S&P 500.

Tara Winslow: Yeah. And I’m an investor in the S&P 500, okay? And I believe in what I’ve learned throughout my life, is to be diversified in my portfolio. So, I’m doing multiple things. And that includes real estate as well. And I think that’s one of the best ways you go, because, you know, look, let’s look back 30 days, right? We’re in the month of March. People are losing, whatever money that you have invested, that’s a lot of money to you, if it’s 10,000, hundreds of thousands, millions of dollars that you’re losing.

Tara Winslow: Now, when you think about real estate, you’re in a house, and the only way that you really lose this investment is if it burns down, and then you have insurance, right? So, when you look at something stable and sturdy like that versus kind of the roller coaster of the market that many of us are dealing with, including myself, I just don’t see how real estate wouldn’t be an option for you to add into your portfolio. The benefits outweigh the maintenance of buying a HVAC every 20 years for yourself.

Mike Blake: So, what do you think? I mean, have you worked with home flippers? And if so, what do you think of flipping is an investment strategy?

Tara Winslow: Well, I think that flipping is a solid investment strategy. I think that the Atlanta market, to find flipping opportunities for my investors, it’s a really tight market, meaning that they want to make a certain amount of money and there’s only a certain amount of properties. And we’ve already talked about shortage, right? The shortage of inventory. So, between the shortage of inventory, then all of their cost, their holding costs, the margins are really getting tight for flippers in the marketplace. Can you find them? Yes, you can.

Tara Winslow: And there is a great opportunity. I’d also suggest that instead of maybe flipping, that you are investing and turning it into a rental because rentals are still hugely needed. There is so much demand for a rental home, an Airbnb home. And again, with a lot of people, there are a lot of people in distress right now with job changes, and losses, and job reduction, hours and reduction, that people are going to be making some changes and it may be, a rental property is more comfortable for them right now. So, I would have someone think about it from a little bit different from a longer-term strategy than maybe from a flipping perspective in today’s market.

Mike Blake: So you brought something up, and we’ve kind of touched upon this, but I want to hit it hard because I think it’s a very important point, which is, you know, is there an environment now where maybe bargain hunting is more feasible today than it might have been four to six months ago, right? You brought up Airbnb and something I’ve been reading a lot is that market is in a lot of trouble, right?

Mike Blake: Because nobody’s traveling, right? Who in their right mind wants to stay in a stranger’s house for a lot of reasons, right? And I think Airbnb just laid off a whole bunch of their staff as well. So, if you bought a property as an investor, and you’re banking on Airbnb income, that’s not there anymore. And that may lead to an opportunity where somebody just wants to pull the ripcord, and get out, and reshuffle the deck. Well, what do you think about that?

Tara Winslow: Well, I have a couple of comments. You know, the Airbnb community is pivoting and how they’re pivoting, and it’s in the works right now, they’re pivoting from a cleanliness standpoint and they’re following the guidelines of the CDC to get certified cleanliness for their houses. So, that’s going on right now, okay?

Mike Blake: Yeah.

Tara Winslow: That’s about all that I have in terms of information on that piece. But in terms of rentals, I mean, I think that they’re continuing to go up in price. And, you know, that’s a tricky question, Mike. Overall, prices are stable, okay? Overall, we’re getting multiple offers. And the strategy has not changed. If a house is in great condition and it’s priced correctly, it’s going to have multiple offers. So, in terms of that buyer looking to steal that house, it’s really still not going to happen. If you’re looking for a house to do work on, that is probably your best investment. You put equity into the home, and then either sell it, live in it, or rent it. And that’s where you might find a better deal. But it’s really a needle in a haystack still.

Mike Blake: So, if I’m going to do that, you know, do I need to be a DIY home builder, Bob The Builder kind of junkie, where I just know how to fix everything, and I’m like my grandfather who can go in, and take apart my water boiler, so he can replace a six-dollar part with nine hours of effort. I mean, do you need to have that kind of building acumen to do that?

Tara Winslow: You know, buyers are so smart these days, okay? And to put junkie work into a house, they see it. So, I would hire a professional and I would also hire a professional property management company, will eat into some of your profit, yes, but you’re going to get the clientele that you want renting your house, you know, if that’s the route that we’re talking about going. So, do a great job, hire someone professionally, and get the money. That way, you’re going to net more money when the work is done professionally than someone sees, do it yourself, an inspector goes in there and there’s tape around the plumbing, you know.

Mike Blake: Yeah. Now, as a realtor and I’m going to come back to that term in a second because there’s a question I’m dying to ask. But as a realtor, can you sit down and help somebody kind of work through and crunch the numbers as to whether or not that investment property makes sense, right? Because again, no, there’s no false modesty here, I’m not a real estate guy, but if I’m, myself, thinking about, hey, you know, I think I could probably sustain a piece of real estate, the investment thesis makes sense, but, you know, I’m not even allowed to have power tools.

Mike Blake: My insurance writer will not allow it because that’s how incompetent I am. You know, can somebody like you help me work through the numbers of, you know, what is it going to cost to bring a property up to code or make it rentable basically, and work through the numbers to see if it’s, you know, more likely than not going to be profitable, or do I need to hire another specialist, or a CPA, or, you know, something like that?

Tara Winslow: Yeah. I mean, we can do a Zoom call. I was going to say sit down for a cup of coffee, but yeah, let’s break out the Excel spreadsheet down and dirty, put in all the cost, let’s see what you’re looking at. And are you okay with the outcome in the return on investment? This would be my discussion I’m having with my client. And if that’s what they’re looking for, their rate of return, then great. There aren’t going to be surprises because we’re going to pad in a little of potential surprise or maybe extra holding costs, but that piece of it’s pretty black and white when you’re looking at the numbers. So, I say that piece is pretty easy to do.

Mike Blake: Sitting there for coffee sounds so February. So, I have to ask you this, totally off script.

Tara Winslow: Yeah.

Mike Blake: As a realtor and people who do what you do, are you like told off the TV show Modern Family, where the main character, Phil Dunphy, is a realtor?

Tara Winslow: I don’t watch that show, so I’m not-

Mike Blake: You don’t?

Tara Winslow: I don’t. I don’t watch a lot of TV.

Mike Blake: Oh, wow. Yeah, that explains why you’re smart. So, if you do, watch Modern Family, I got to think that one of the main characters is a realtor, and really spends a lot of time talking about sort of the real estate industry, and he’s really into it. So, I had to take a shot in the dark and see if you’re familiar with the show. But now, on the other side, you know, what are some common mistakes that are made by investors in real estate? I mean, this is not a slam dunk. There are some risks to it.

Tara Winslow: Yes.

Mike Blake: Where is it most likely you can make a mistake, where you really step in it.

Tara Winslow: Yeah. From an investing standpoint, this is the best way I can say it. Don’t put lipstick on a pig, okay? The buyers are too smart. Don’t think you can go in there and put a new carpet, new paint, and expect to get top dollar, and it’s not going to come out in the inspection that you, you know, hit a leak. Just go in there, do the work, get a great reputation because realtors like me are going to come back to you and say, hey, what do you got coming down the pike?

Tara Winslow: I got a buyer ready to go. And you build your reputation like that. You know, I had an interesting thing happen this week. One of my buyers went with an investor property and we had an inspection. And small world, this inspection company, it’s a small inspection company, about five inspectors, one of their teammates had just inspected this same house, three days before, and also gave it a bad inspection.

Tara Winslow: So, what’s the likelihood of the same inspection company going to the same house with all, the thousands of houses in Atlanta, right? And the inspector said, “And they still didn’t fix anything that we had recommended from the first inspection. And so, we terminated it.” And, you know, am I going to go back to that investor? I know how they work now. So, do a good job, and you’re going to get a great reputation, and you’re going to sell more of your properties. That would be my advice.

Mike Blake: That’s a really interesting answer. I pause because it’s totally not what I expected that you would say, which is great. Again, reveals my ignorance.

Tara Winslow: It’s a real-life example, right?

Mike Blake: Yeah. No, sure. I mean, you know, when I sat down, I wrote that question from the perspective of, I don’t know, you buy the wrong property, you talk yourself into buying something, yes, pretty generic stuff. It hadn’t occurred to me that your behavior as an investor on the exit side is so important, right? And developing a reputation because, you know, at least Atlanta, we all call it a big, small town. And it really is, right? We have seven million people here, but everybody knows everybody who’s worth knowing. Let’s face it.

Tara Winslow: That’s right.

Mike Blake: And a bad reputation is very tough to shake in this town, right?

Tara Winslow: Agreed.

Mike Blake: But I have not thought of the risk of becoming known as basically, a purveyor of damaged goods, and that most sellers would want to avoid that reputation, basically, unless you’re planning on fleeing the country the next week, right? That’s pretty much-

Tara Winslow: And that’s not a good business model, right?

Mike Blake: Especially now, where are you going to go?

Tara Winslow: Right.

Mike Blake: Mozambique, I think, has many people, and that’s about it. So, we’re running out of time. We’re going to wrap this up, but there’s one last question, is, you know, I think we would both agree real estate investing is not necessarily for everybody. Who should not be investing in real estate, right? Is there an economic profile or a psychological profile of some of those, just, you know, this really is not the kind of vehicle that’s right for you, you ought to think about doing something else?

Tara Winslow: Well, you know, Gary Keller says, when’s the best time to buy real estate? Yesterday, right?

Mike Blake: Yeah.

Tara Winslow: So, I’m of the same mindset. I think everyone should invest in real estate. But to answer your question, you know, I do come across certain clients who, on a scale of one to 10, their risk taking may be a one which is a low side, and that’s fine. And if that’s where it is, I would recommend investing, there may be other ways we can handle real estate and not necessarily invest and rent, or flip, or one of those options, you know, that maybe you purchase a duplex and you live in one side of the duplex, and then you rent out the other side, you know. Taking baby steps, sometimes, with a little bit more risk-adverse personalities, I think is probably the best way to go.

Mike Blake: Okay.

Tara Winslow: Yeah.

Mike Blake: And I’ll highlight here, just so everybody understands, neither of us is offering investing advice, we’re just covering a particular asset class. But everybody’s risk profile, everybody’s return needs, liquidity needs are different. You know, evaluate your own investments, whether it’s real estate, or taking your own circumstances into account. And, you know, if you don’t work with an investment adviser, you know, you probably ought to consider using one. I’m a big fan of investment advisers, because if you don’t do this stuff for a living, it can be gobbledygook. And even if you do, do it for a living, having somebody that’s going to help you will be useful. Tara, this has been a great interview and you’ve shared a lot of great information for our listeners. How can people contact you for more information?

Tara Winslow: Sure. They can contact me via email at tara.winslow@kw.com. My website is tarawinslowhomes.com. I’m on Instagram as, Tara Winslow Homes, LinkedIn, Facebook, any way. My phone number is all on those sites. Happy to provide a consultation if you just want to pick my brain about real estate.

Mike Blake: Well, great. That’s going to wrap it up for today’s program. I’d like to thank Tara Winslow of Keller Williams so much for joining us and sharing your expertise with us. We’ll be exploring a new topic each week, so please tune in so that when you’re faced with your next executive decision, you have clear vision when making it. If you enjoy these podcasts, please consider leaving a review with your favorite podcast aggregator. That helps people find us so that we can help them. Once again, this is Mike Blake. Our sponsor is Brady Ware & Company. And this has been the Decision Vision podcast.

Rick Higgins is Owner and President of

Rick Higgins is Owner and President of

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at